ARE YOU A SMALL BUSINESS IN NEED OF FAST FUNDING? DO YOU HAVE AN EXISTING LOAN AND NEED MORE MONEY. WE CAN HELP YOU!

Our minimum qualifications are less than banks and other loan companies. We're focused on getting you approved and getting you the funds you need. With us you can also borrow again before your loan is paid off!

Time in Business

You only need to have been in business for 1+ years.

Revenue to Qualify

Your business needs to gross $12,500 per month

Industries

There are over 725+ industries that we fund.

Personal Credit

All that is required is a personal credit score of 450+

Location

We fund businesses in all 50 states.

Click on these

Types of Loans

Money Tree Financial Services is a leading brokerage firm with over $3 billion of funding available. Money Tree Financial Services business loans provide your business loans it needs for:

- Growth, Expansion or Renovation

- Improve Cash Flow

- Working Capital

- New Technology

- Insurance and Tax Payments

- Additional Staffing or Payroll

- Inventory or Advertising

We provide funding based upon your ability to pay back the loan. Not on your credit score like banks and other lending companies do.

Types of Loans We Fund:

Unsecured Business Loans

- We offer loans from $10,000 to $5,000,000

- Our terms are between one to five years

- We offer daily, weekly or monthly payments

- Good Credit Loans

- Bad Credit Loans

- Rates starting as low as 5.49%

- Borrow again before the loan is paid off

Working Capital Loans

Working Capital Loans are used for daily operating expenses. The daily operating expenses can include, payroll, rent, marketing, Immediate renovations, debt consolidation or purchasing inventory (just to name a few)

Bad Credit Loans

We provide Bad Credit Loans to businesses where the owner has a FICO credit rating of 450 or more. We lend up to 10% of the businesses annual gross sales. On this program we lend from $10,000 to $2,000,000. The terms are from 5 months to 21 months. Payments are fixed at daily, weekly or monthly.

Commercial Real Estate Loans

If you are renting a building now for your business you no longer have to throw your money away paying rent. You can purchase a building as long as your business occupies 51% of the building with no money down. The purchase price for the building can be up to $1,000,000. With no money down the monthly payment would be about $7,000 per month. So, with no money out of pocket you could start building equity.

Merchant Cash Advance

With the Merchant Cash Advance, you are able to get funding up to $500,000. You can get up to 13% of your annual credit card processing sales. Rates as low as 1.18%.

- Funding in as little as 2 business days

- Make variable daily payments that fit your budget

- No personal collateral of putting up assets

- No set date to mature means total flexibility on your terms

- Borrow again when the cash advance is paid down to 50%

SBA Loans

We specializein SBA Loans. In most cases, we can get you approved and funded in one to six weeks. Most lending companies take 3 to 4 months. The SBA is a great solution if you are looking for small monthly payments. Their business loans “go out” 10 years. The Small Business Administration is a Federal Agency they partially guarantee the loans.The rates for working capital loans are variable they range from Prime Rate plus 2.75% to Prime Rate plus 3.75%.

SBA Quick Start Loan Program Fund in 7 Days

If these SBA Loans are so great, why doesn’t everyone apply?

The biggest deterrent is the requirements. They are tough. There is a ton of paperwork.

On top of that, you must meet the underwriting criteria of both SBA and the lender. We offer a Quick Start Loan Program because we have dealt with both SBA and the lender for many years and have been able to fund thousands of loans we know exactly what the requirements of each of them are.It is not uncommon for other loan companies to take 3 to 4 months to get funding, if they get you a loan at all.

How are the SBA loan rates so low?

The loans do have Personal Guarantees – that is how you receive the low-interest rate. You must have personal collateral and assets to pledge plus have “skin” in the game. Assets can include residual or commercial real estate, equipment, and cash equivalents like money market, savings account or checking account.

Do you want to Refinance Your Outstanding Business Debts ?

The debt consolidations loans are a great option. Imagine significantly reducing your payments. Those massive unwieldy debts that crush cash flow and make day to day operations challenging can be a thing of the past.

Refinance

High-interest credit cards

Any daily or weekly business loans, fixed or variable

Short tern business loans

High-interest business loans

Conventual Loans

Business or merchant cash advances

Do You Need Working Capital to Energize Your Business ?

If you need working capital and hate the short-term and high-interest loans, this is for you. Imagine if you can qualify for an SBA loan you will be able to deal directly with an SBA lender and not have to go through the challenge of applying directly with a bank. We all know that banks do not make it easy.

What can you use the funds for?

Here are six quick ways you can use the capital provided by an SBA loan. They include:

- Bulk purchase of inventory

- Refinance high debt and save

- Replace outdated equipment of technology

- Build your team of employees

- Day to day operations

- Kick off long-term marketing and advertising programs

To Find Out if You if You Can Qualify for a SBA Loan do the Following:

- Get Pre-Qualified Quickly

- Find Out Within 10 Minutes

- No Impact to Your Credit Score

To qualify for an SBA loan, you will need the following:

- 680++ Fico Score with good loan to debt ratio (Not maxed out on debt)

- Sufficient business and personal cash flow to service all debt payments

- No bankruptcies, judgments, or foreclosures in the last three years

- No collections or tax liens

- Minimum 3 years in Business

- All persons that own 20% or more of the business must be on the Application

- No sole proprietor’s

- Secured with a Blanket Lien on Business Asset Plus Personal Guarantees

Applying for an SBA Loan:

- Complete & Sign Application

- Business Tax Returns – 3 years with interim P&L

- Personal Tax Return – 3 years (All owners with 20% ownership or greater)

- Business Debit Information – we will email you for this information

- Profit and Loss Statement a.k.a Income Statement

- Balance Sheet

- Collateral 10% to 20%

10 Minute Pre-Approvals

As soon as we receive ALL of the above, we will have a pre-approval very quickly. Incomplete submittals will create a delay in pre-approvals. We will then reach out to you if additional items are needed. If all of the paperwork is submitted, it can take seven business days to six weeks to fund. Compared to other lenders that take 3 to 4 months and many times they can’t get you the funding. With us through the SBA Program, we can lend you up to 20% of your annual gross sales up to $2,000,000.

SBA Commercial Real Estate Program

This is a great program if you are in a building that you are renting and are just throwing away thousands of dollars per month for rent.You can stop that with this no money down SBA Program, you can purchase a commercial property, as long as you occupy 51% of it. If you would like to start building equity rather than paying rent.Please get in touch with us, we have done a lot of these.You can get funding from $350,000 to $5,000,000 to purchase the property with no money down. The interest rate is also very good it is the Prime Rate plus 1.5%.

What are the Pros and Cons of SBA Loans?

The Pros:

The main advantage to an SBA Loan is the fact that the business owners can use the funds for virtually any kind of business need. Most business owners often use the money that they get from SBA loans to increase their capital, refinance debts from other institutions, purchase better equipment and machinery and fund acquisition of competing businesses to name a few.

The payment terms offered by SBA loans are also better than the usual bank small business loan. Most entrepreneurs can take advantage of the SBA loans usually have low down payment options.

Payment terms are also longer, and interest rates are known to be much less vs, other small business loans.

The Cons

What’s the down side? Completing the application process is usually longer and more tedious than a standard loan. That is because you need to file a separate set of requirements to both the SBA and the lender.

Also, when dealing with the SBA the application processcan take 3 to 4 months. We have been dealing with the SBA and with SBA lenders for many years and normally can get you funded in one to six weeks.

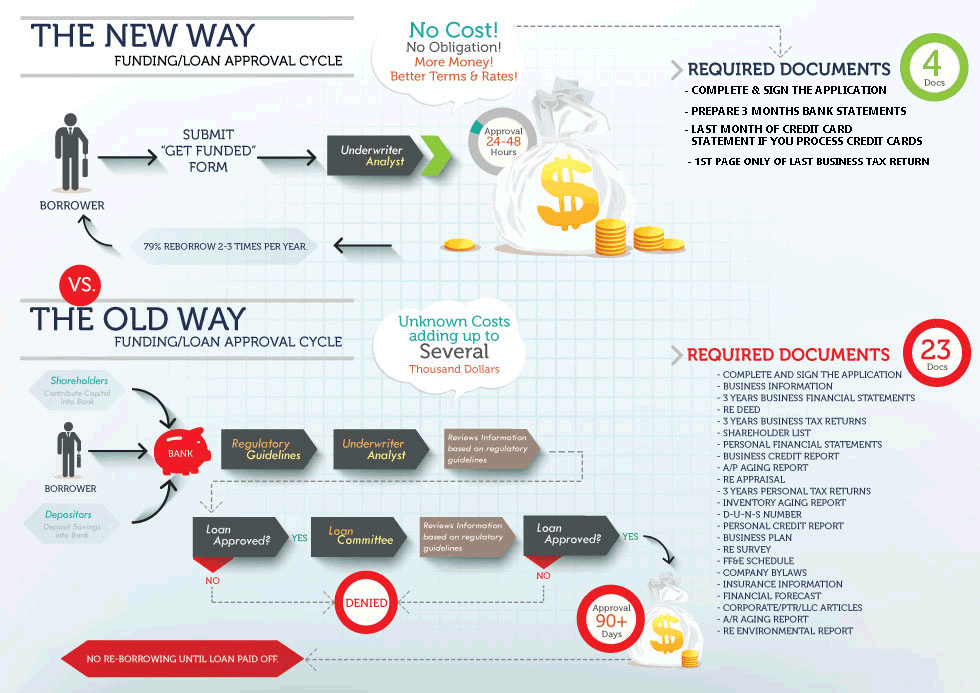

Compare

"The Old Way" vs "The New Way"